Carpet Depreciation Irs

Net investment income tax niit.

Carpet depreciation irs. See irs publication 5271. You must submit a separate form 4562 for each business or activity on your return for which a form 4562 is required. Income tax return for an s corporation regardless of when it was placed in service. Special depreciation allowance or a section 179 deduction claimed on qualified property.

You may be able to elect under section 179 to recover all or part of the cost of qualifying property up to certain dollar limits and thresholds based on property cost. You may be subject to the net investment income tax niit. Repairing is the key to your tax treatment replacing destroyed appliances carpet and linoleum are an asset and depreciated 5 years. If you didn t deduct enough or deducted too much in any year see depreciation under decreases to basis in pub.

If the carpet is glued down perhaps in a basement then it becomes attached to the property and must be depreciated over 27 5 years. As such the irs requires you to depreciate them over a 27 5 year period. Say you hold the rental property you bought for 240 000 for 10 years and you ve written off 74 130 in depreciation deductions. Like appliance depreciation carpets are normally depreciated over 5 years.

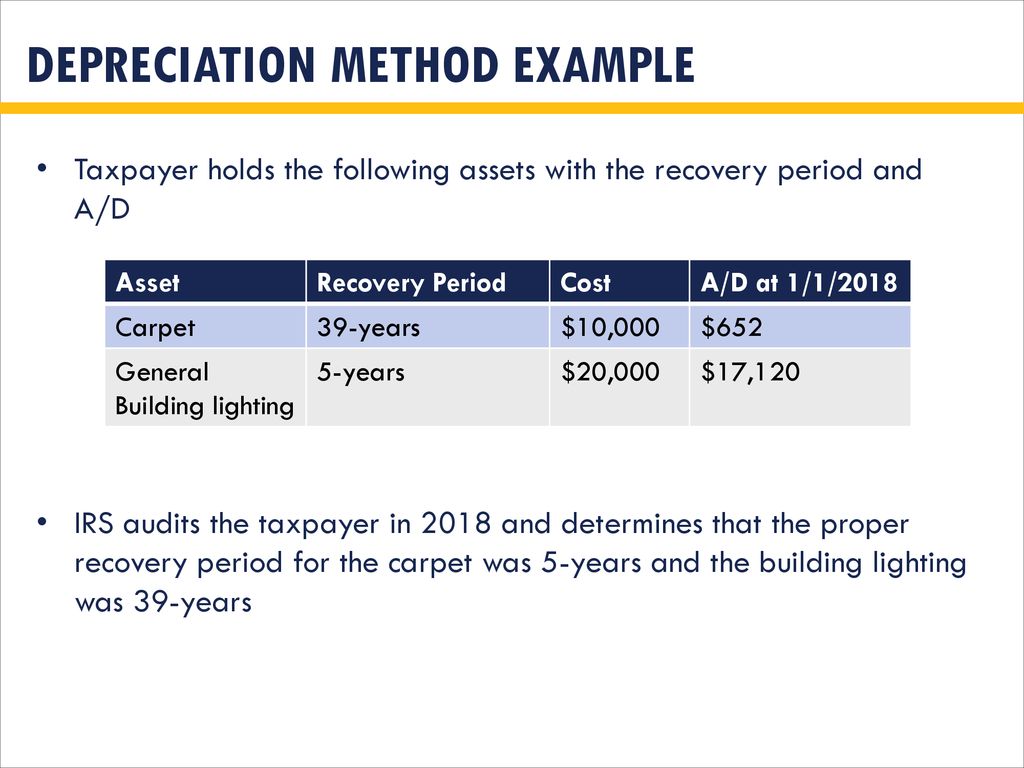

As more fully set out in 26 u s c. See irs gov form1040x for more information about amend ing a tax return. Depreciation you deducted or could have deducted on your tax returns under the method of depreciation you chose. This applies however only to carpets that are tacked down.

You deduct a part of the cost every year until you fully recover its cost. Tax year 2018 you will need to file an amended return form 1040 x to do so. Rolling out tacked down carpet tacked down carpet is different from other types of flooring because it is relatively easy. Internal revenue service here s an example.

Depreciation or amortization on any asset on a corporate income tax return other than form 1120 s u s. Niit is a 3 8 tax on the lesser of net in vestment income or the excess of modified ad. Depreciation is the recovery of the cost of the property over a number of years. Most repair costs that are results of the tenant destructive actions are fully tax deductible in the year incurred.

:strip_icc()/how-to-calculate-your-modified-adjusted-gross-income-4047216_final-c4dcde21c50f43fd915e310e9a00a3ae.png)

/GettyImages-88305470-6152a026f81d4a9198db0eeb8cbca446.jpg)