Carpet Depreciation Life Irs

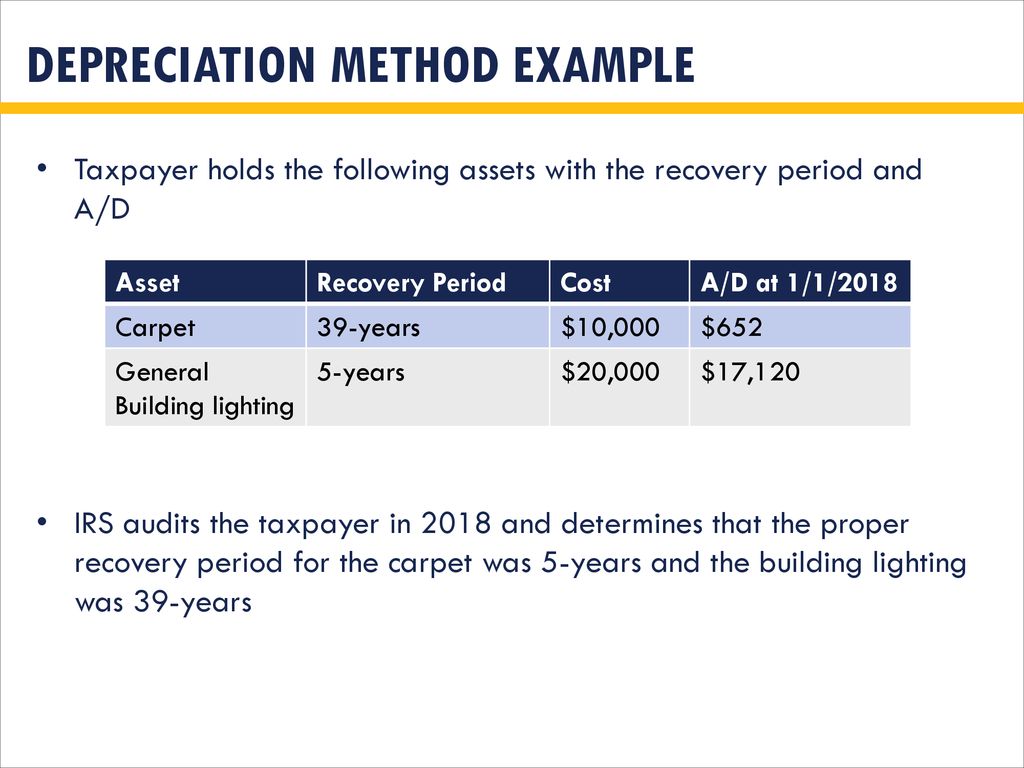

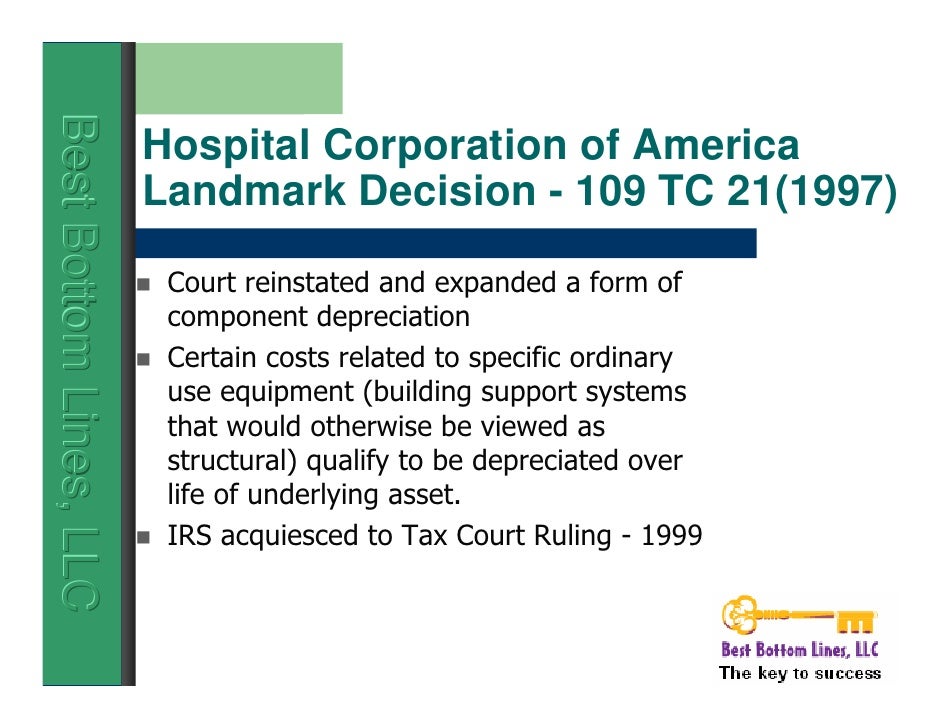

For recovery periods under irc 168 g alternative depreciation system see revenue procedure 87 56 1987 2 cb 674 if the taxpayer s tax return position for these assets is consistent with the recommendations in exhibit a examiners should not make adjustments to categorization and lives.

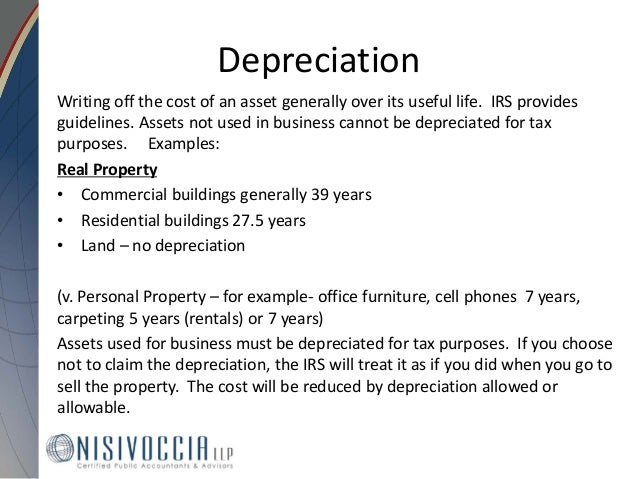

Carpet depreciation life irs. Income tax return for an s corporation regardless of when it was placed in service. This applies however only to carpets that are tacked down. It is based on the idea that every asset has a useful life a period of time over which it remains useful and productive. Depreciation is a business tax deduction regulated by the internal revenue service irs.

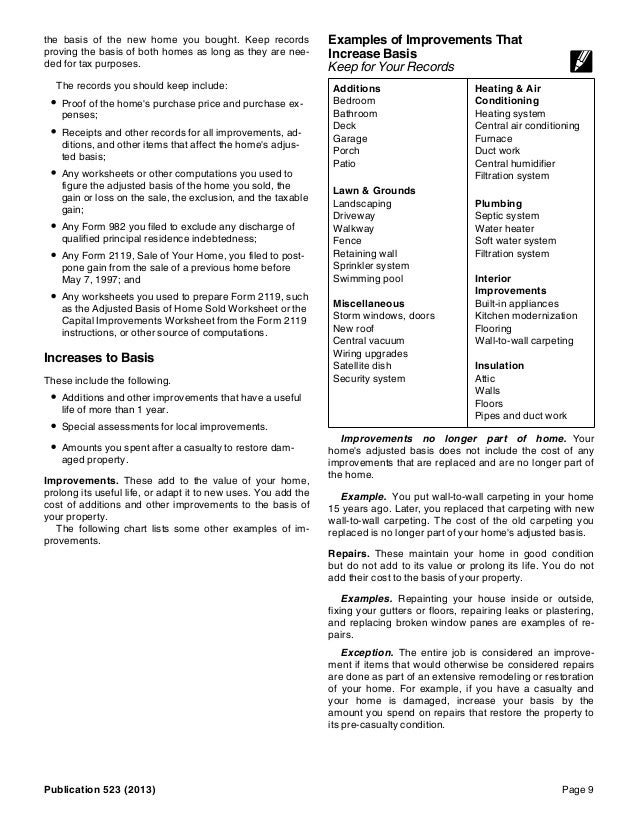

See irs gov form1040x for more information about amend ing a tax return. If you didn t deduct enough or deducted too much in any year see depreciation under decreases to basis in pub. Net investment income tax niit. Repairing is the key to your tax treatment replacing destroyed appliances carpet and linoleum are an asset and depreciated 5 years.

The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168 a of the irc or the alternative depreciation system provided in section 168 g. Useful life of more than 4 but less than 10 years that is 5 9 years. Thus the irs does not think that all residential rental carpets only lasts five years but the irs does think that most such carpets last between five and nine years based on a study of carpets by the irs. Instead you generally must depreciate such property.

Like appliance depreciation carpets are normally depreciated over 5 years. At the end of its useful life it is expected to be obsolescent. Depreciation you deducted or could have deducted on your tax returns under the method of depreciation you chose. Special depreciation allowance or a section 179 deduction claimed on qualified property.

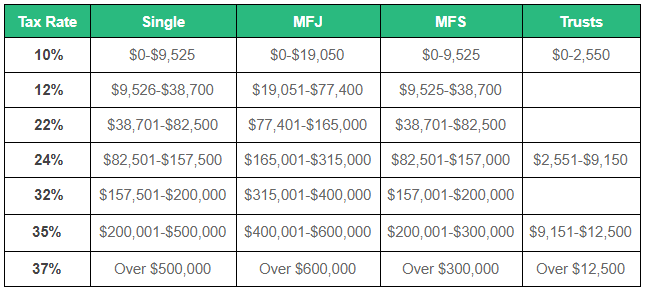

Niit is a 3 8 tax on the lesser of net in vestment income or the excess of modified ad. If the carpet is glued down perhaps in a basement then it becomes attached to the property and must be depreciated over 27 5 years. You generally can t deduct in one year the entire cost of property you acquired produced or improved and placed in service for use either in your trade or business or to produce income if the property is a capital expenditure. Tax year 2018 you will need to file an amended return form 1040 x to do so.

The macrs asset life table is derived from revenue procedure 87 56 1987 2 cb 674. Depreciation is the recovery of the cost of the property over a number of years. Most repair costs that are results of the tenant destructive actions are fully tax deductible in the year incurred.