Carpet Effective Life Ato

Canberra june 2019 c319 00001.

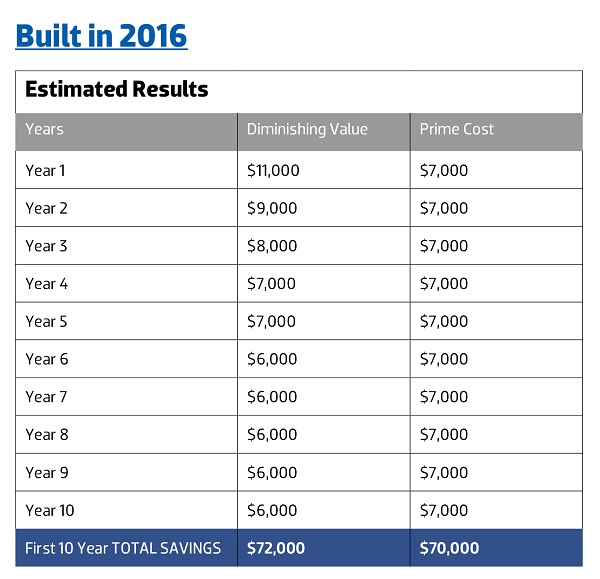

Carpet effective life ato. The dishwasher has an effective life of 5 years and diminishing value rate of 25 per cent. How the ato determines the effective lives of assets. This is calculated by dividing 200 by an effective life of 10. Deductions for decline in value over the effective life assets bought after 9 may 2017 at the start of 2016 marty purchased a home as his main place of residence.

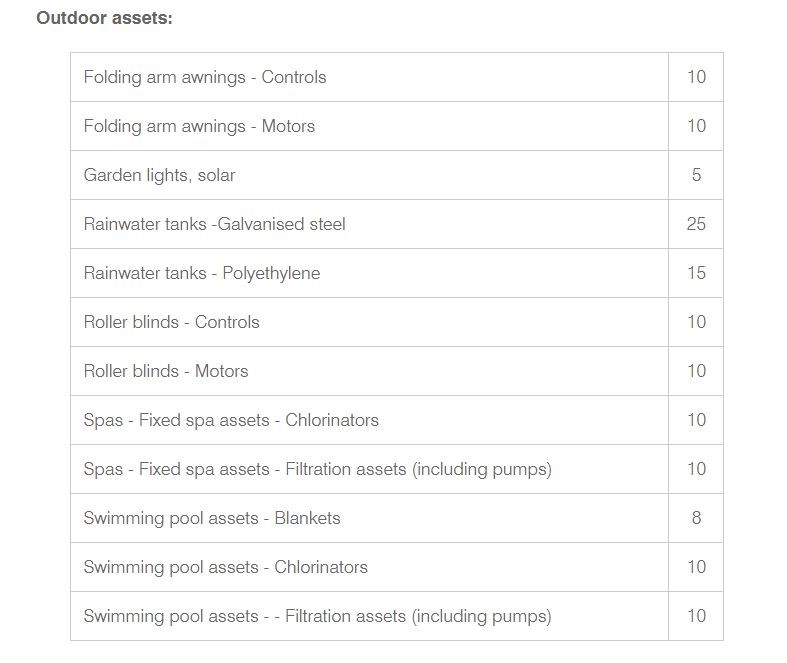

Below are the ato effective lives for residential property as at the 1st of july 2019 from tr 2019 5. Recalculating a depreciating asset s effective life. Manufacturing 11110 to 25990. The effective life of this item in a residential property according to the ato is ten years.

For the most up to data effective lives go to the ato effective lives section under the depreciation schedules menu dropdown. Rental properties 2019 ato gov au 1 contents introduction 3 changes to deductions for travel expenses 3 changes to deductions for decline in value of second hand depreciating assets 3 tax and natural disasters 3. The effective life legsilation has been updated. Legislative references tax laws amendment 2005 measures no.

The ato determines effective lives through an effective life review process. Using the diminishing value method carpets will depreciate at a rate of 20 per cent. You may have to recalculate the effective life if you make an improvement to an asset that increases its cost by 10 or more in a year. The commissioner is responsible for giving us the effective life of carpet at 10 years.

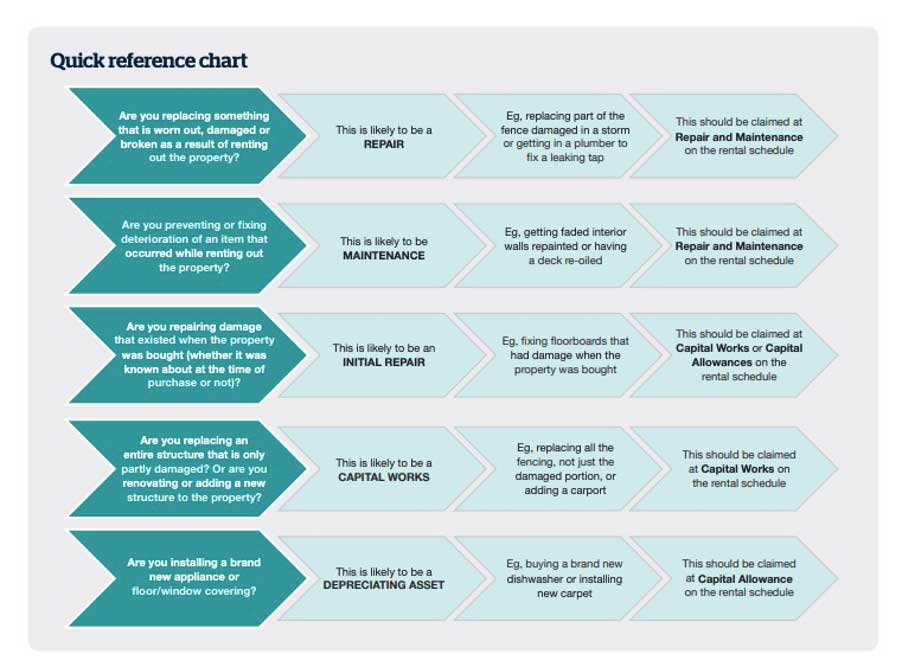

If the item is well past it s life expectancy it would not be fair to award the landlord the full replacement cost because to do so would put the landlord in a better position than s he was in prior to the item being damaged by the tenant. In june 2017 marty moved out and rented out the property fully furnished which included the furniture and fittings he had been using while living there. Take for example the addition of carpet to a rental property. Whether it is carpet a stove mini blinds or a hardwood floor all items have an estimated life expectancy.

If you decide to replace carpets before the ten year effective life is complete be aware that any remaining depreciable value can be claimed as scrapping. Depreciation using an effective life bill owns a restaurant and purchased a new commercial dishwasher for 8 000. Chapter 2 effective life of assets declining in value. Effective life diminishing value rate prime cost rate date of application.

Textile leather clothing and footwear manufacturing 13110 to 13520. This ruling which applies from 1st july 2019 replaces tr 2018 4.